What Accountancy Professionals Are Really Looking for in a Job in 2026

05 Jan, 20261-2 minutes

Introduction

With the pressure to embrace technological advancements and adapt to the growing influence of Artificial Intelligence, the accountancy sector is evolving quickly.

As the profession continues to navigate digital transformation, regulatory changes and the introduction of Making Tax Digital for Income Tax in April 2026, the landscape is shifting rapidly.

Throughout 2025, there have been significant changes in the motivations, priorities and career preferences of accountancy professionals and keeping up with future expectations of employees is essential to remain competitive in the market.

Our report details the preferred salary, perks, work-life balance and flexibility, as well as the company culture, career motivation and development of accountancy professionals in 2026.

Understanding what jobseekers need to thrive and remain engaged has never been more important. However, it’s not just technology that is impacting and reshaping workforce strategies.

Our report examines what motivates professionals in the private sector to stay in their positions. It also explores what drives professionals to seek new opportunities that will better align with their goals and ambitions.

Employers can use the results in our report to discover the thoughts, opinions and motivations of both those actively searching for a job in 2026 and those who aren't.

Key findings

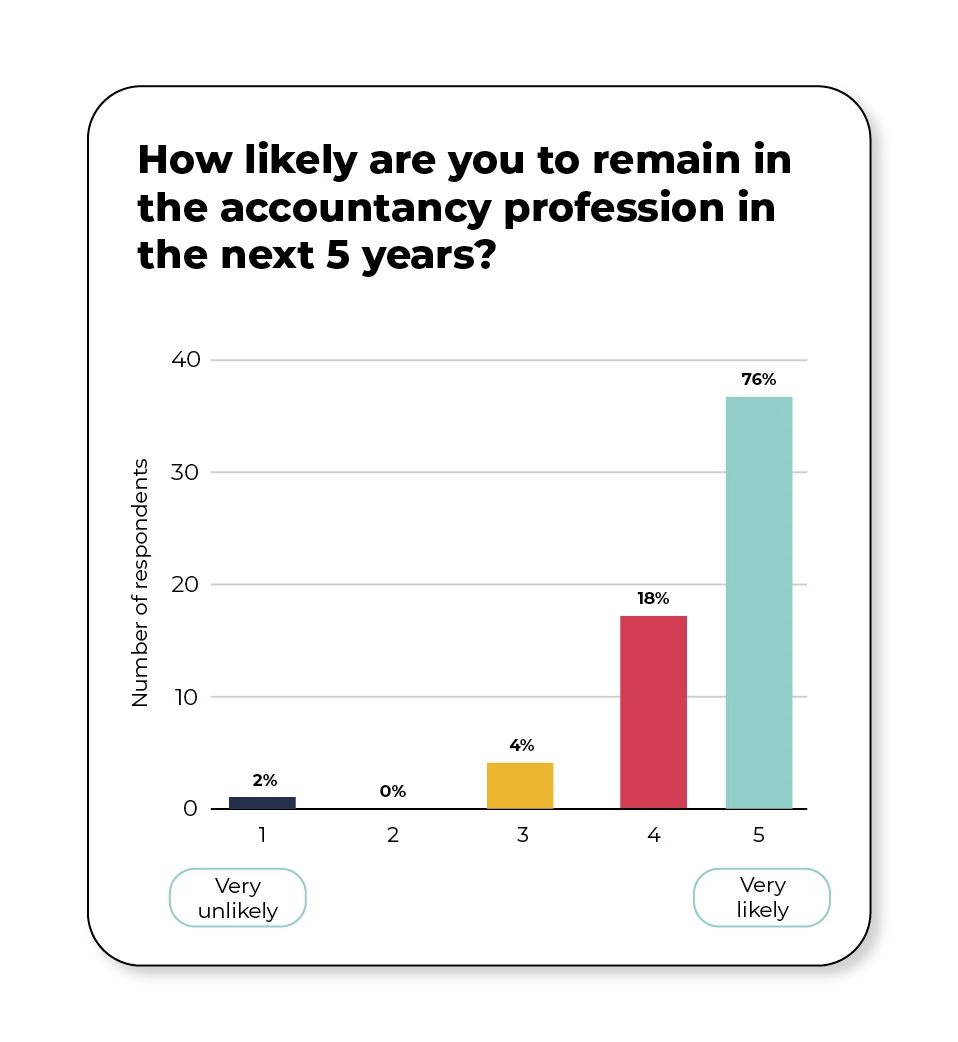

- 76% of accountancy professionals are ‘very likely’ to remain in the profession for the next 5 years.

- Flexibility, remote work opportunities and a healthy work-life balance are key priorities for accountancy professionals.

- 45% cite a healthy work-life balance as the benefit they value the most.

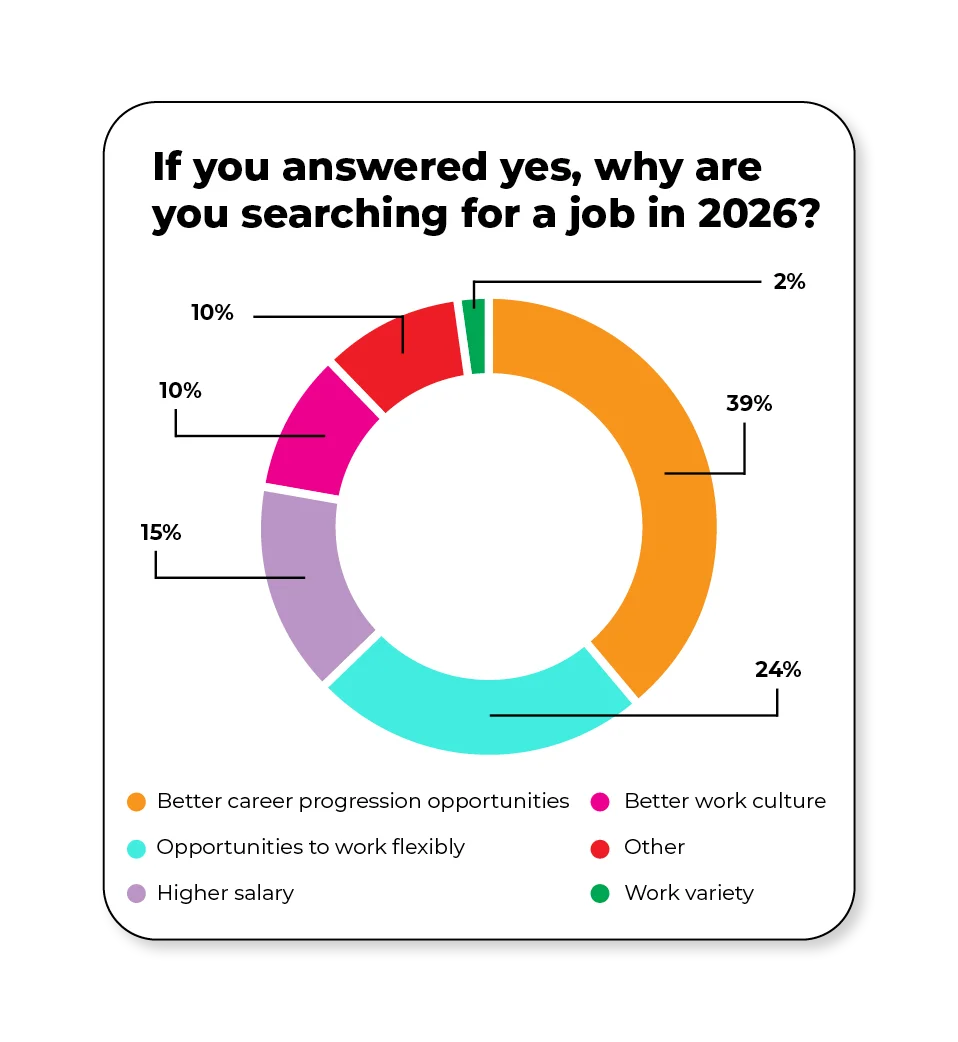

- 39% of professionals are looking for better career progression opportunities when seeking a job in 2026.

- 97% of professionals believe company culture is ‘important’ or ‘very important’ when searching for a job in 2026.

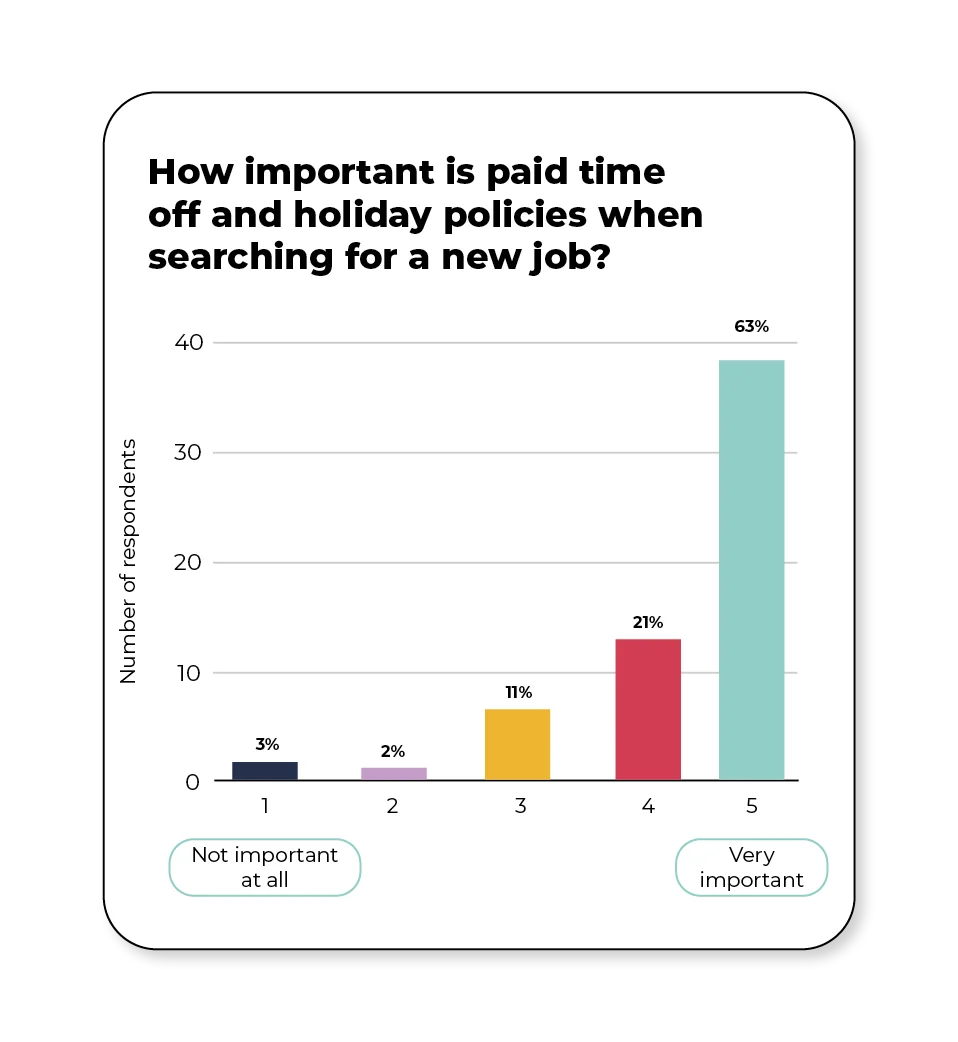

- 63% of professionals believe paid time off and holiday policies are ‘very important’ when searching for a new job.

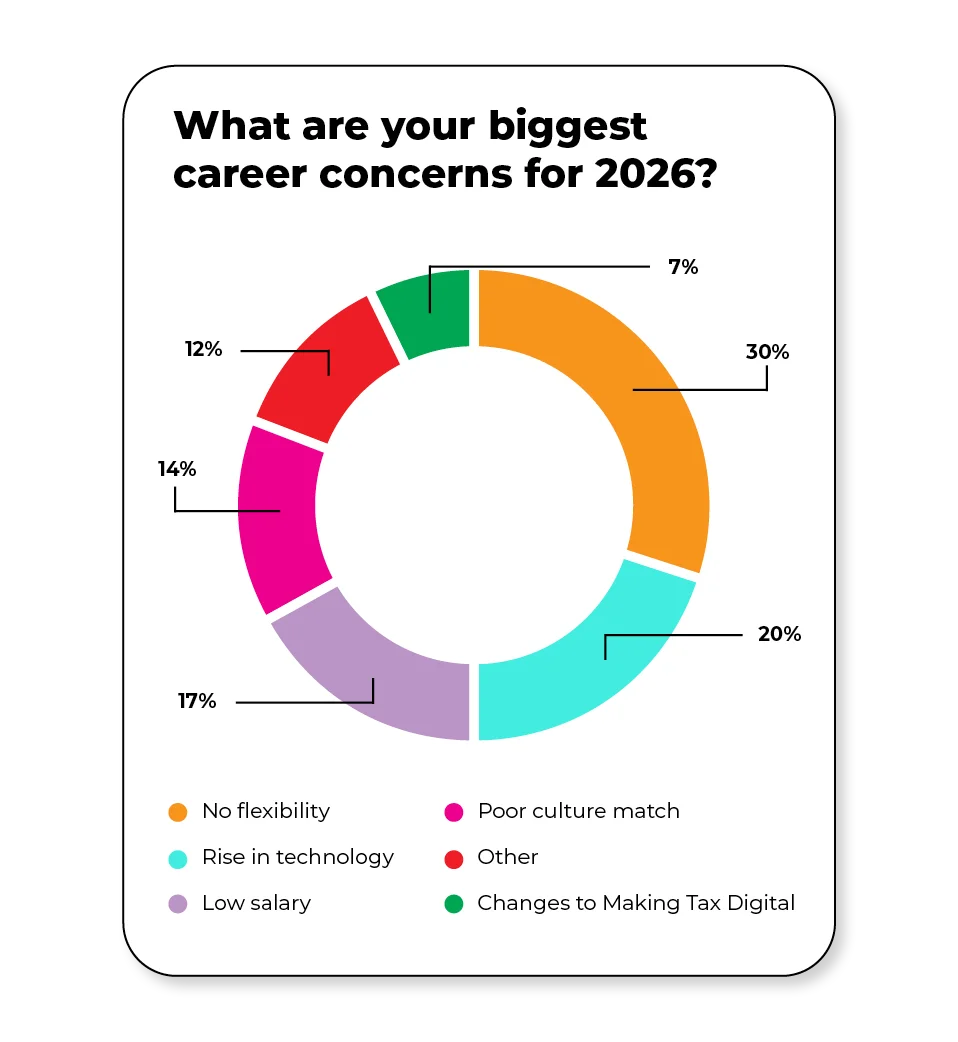

- Only 7% of accountancy professionals identified Making Tax Digital as their biggest career concern for 2026.

- The number of accountancy professionals concerned about the rise in technology doubled from 10% in 2024 to 20% in 2025.

Career motivation and satisfaction

The data within this section details the key factors shaping career motivation and satisfaction among accountancy professionals.

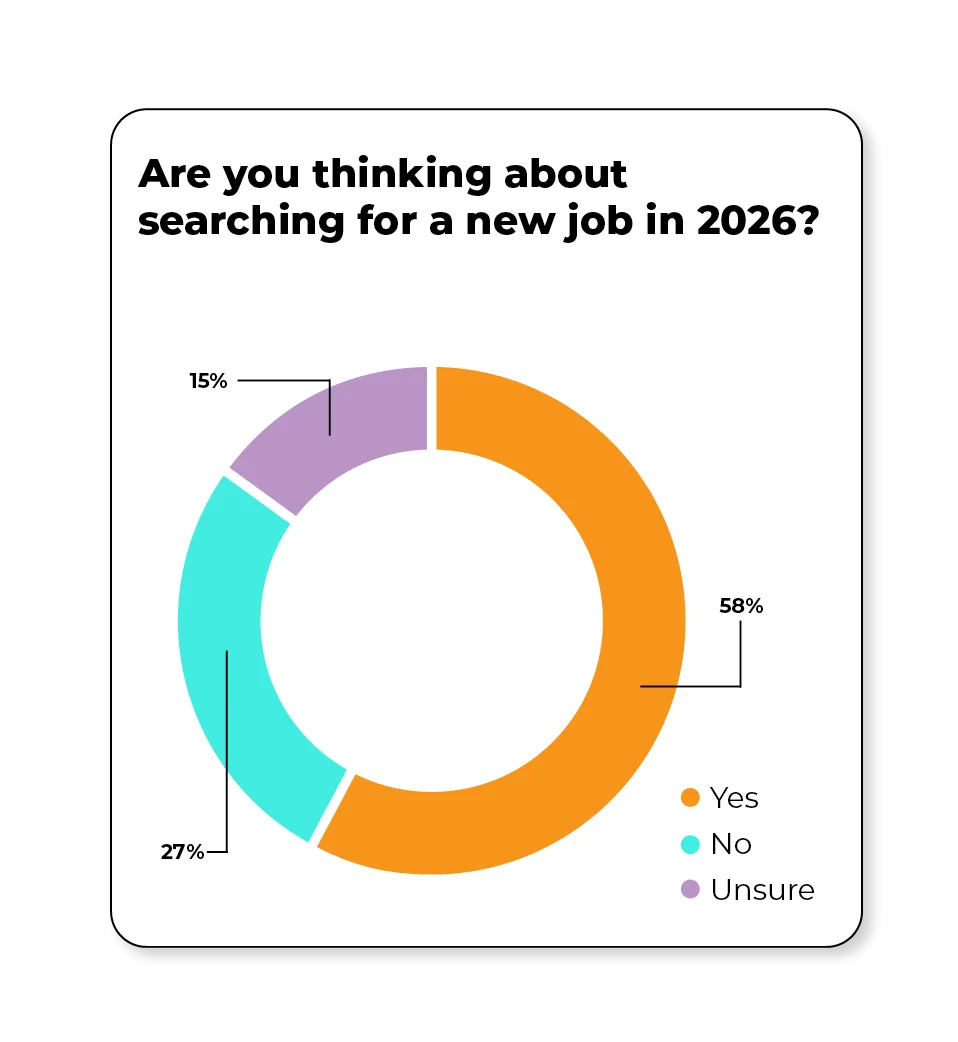

Are you thinking about searching for a new job in 2026?

If you answered yes, why are you thinking about searching for a new job?

How likely are you to remain in the accountancy profession in the next 5 years?

What are your biggest concerns for 2026?

Career motivation and satisfaction key findings

With 94% of accountancy professionals ‘very likely’ or ‘likely’ to remain in the accounting profession in the next 5 years, it’s vital that employers take action and ensure employees are motivated and satisfied.

One accountancy professional said, “Satisfaction is always a concern in any role, but I think it is good to keep roles fluid and changing, passing tasks between team members to keep it interesting.”

Accounting professionals are questioning whether upper management prioritises career motivation and employee development, with many feeling that recognition isn’t always matched with clear or genuine paths for growth.

One accountancy professional added “It’s difficult to be motivated in the workplace. With hard work, you get satisfaction from upper management, but never any career advancement.”

Another added, “I'm still focused on progression, but having time to focus on non-work-related parts of my life is a higher priority.”

With long careers ahead and a continued drive for progression, Accountants want employers who value their efforts and offer flexibility, as well as clear internal paths for advancement.

Another professional said, “Career motivation tends to stay high when I see a path for growth, be it a promotion or skills development. Also, when my contributions are noticed and I can see the positive impact of my work.”

Accountancy professionals want their ambitions to be fulfilled through meaningful development and recognition of their contributions. Where some employers fail to motivate and satisfy, some accountancy professionals are taking matters into their own hands by undertaking courses and qualifications to upskill and improve themselves.

One accountancy professional added, “I think the motivation is to progress. I am currently undertaking a Master of Business Administration to try to take my career to the next level.”

Salary

The section outlines the key findings related to salaries within the accountancy profession.

How satisfied are you with your current salary?

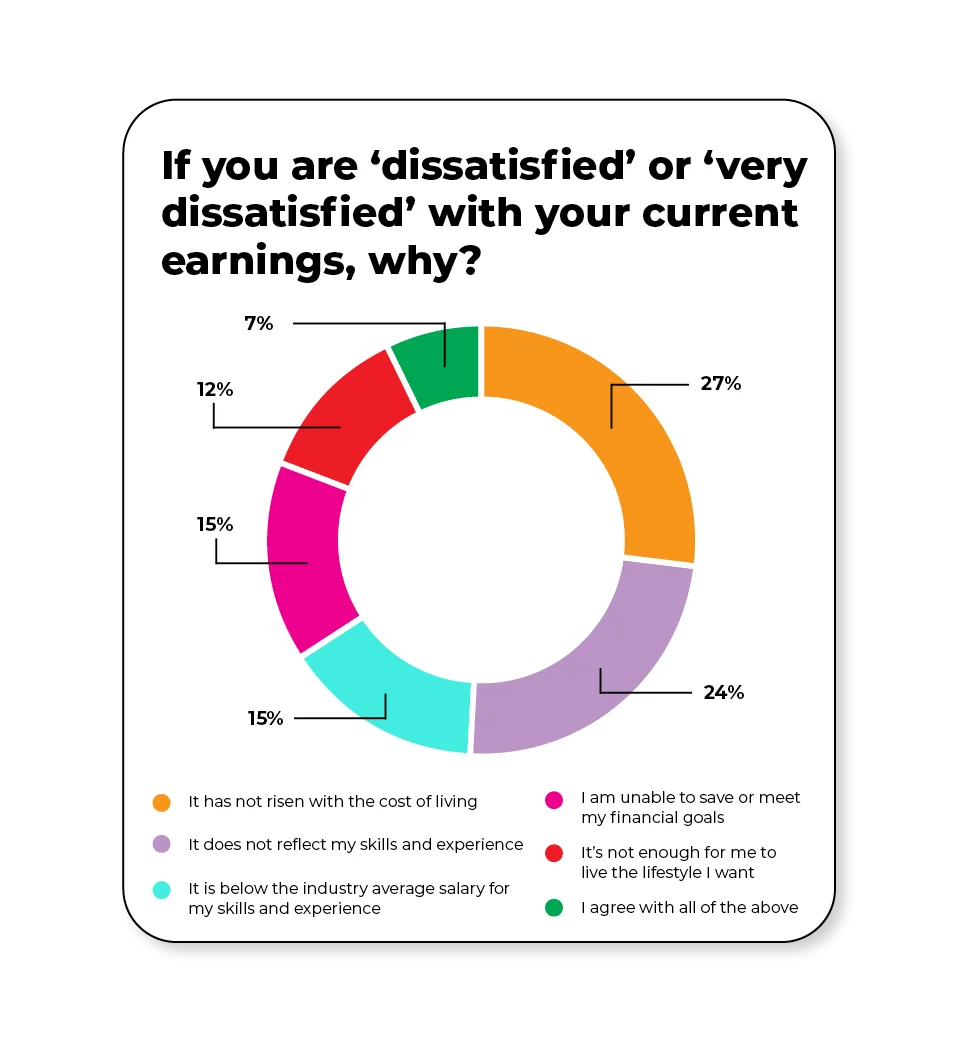

If you are ‘dissatisfied’ or ‘very dissatisfied’ with your current earnings, why?

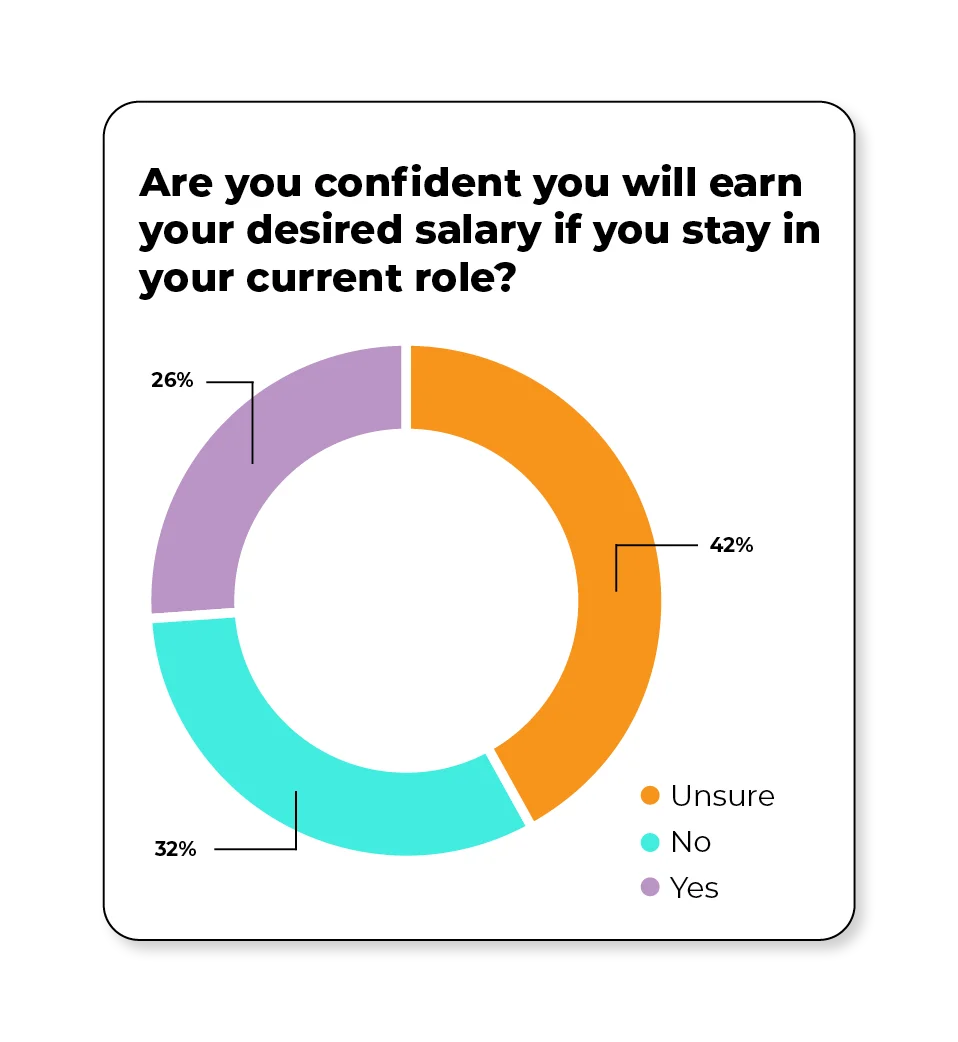

Are you confident you will earn your desired salary if you stay in your current role?

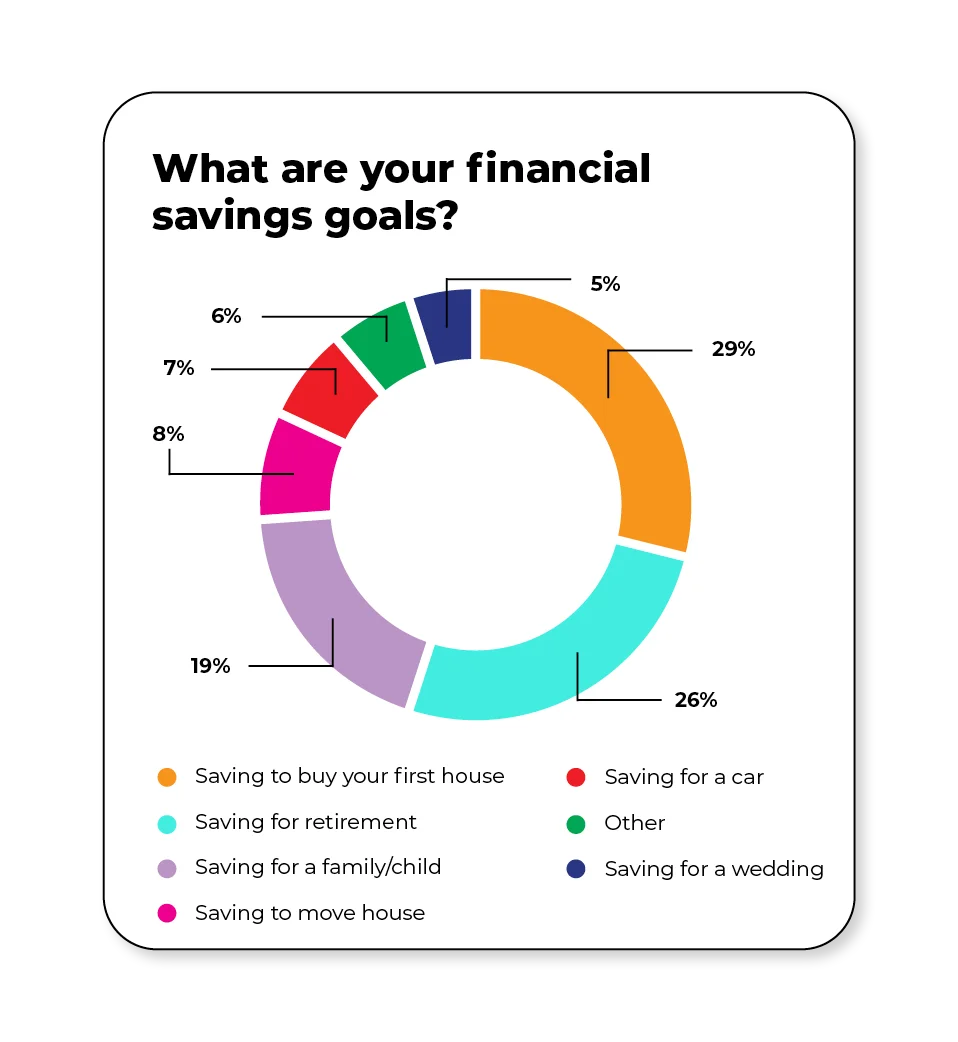

What are your financial savings goals?

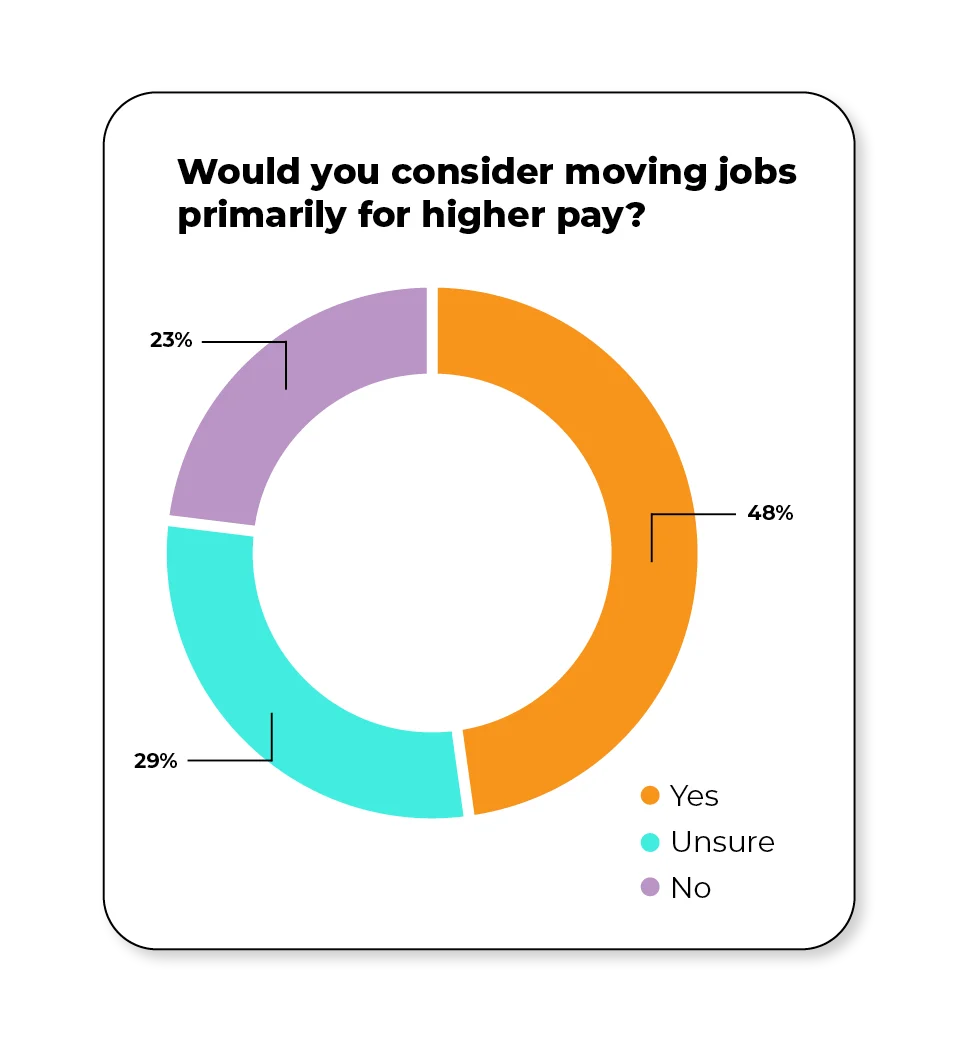

Would you consider moving jobs primarily for higher pay?

Salary key findings

When it comes to salary, accounting professionals seem to be mixed about how much they prioritise it and whether money is a reason to leave their current role.

One accountancy professional said, “It is not that I am unhappy with my pay; I am more unhappy that other people at my company get paid more than I do but do significantly less! It is demotivating.”

48% would consider moving jobs primarily for higher pay, but the same amount said they were ‘neither satisfied nor dissatisfied’ with their current salary.

A second accountancy professional said “It's not 100% about salary. Everyone wants to be paid well, but not at the expense of work-life balance, health, and stress.”

More accountancy professionals seemed to be ‘satisfied’ rather than ‘dissatisfied’ with their current salary, with reasons for dissatisfaction including salaries not rising with the cost of living (27%) and not reflecting skills and experience (24%).

An accountancy professional added, “Salary should reflect not only the role itself but also the level of responsibility, workload and the impact an employee delivers.”

When it comes to financial goals, accounting professionals are largely focused on long-term stability and confidence in achieving desired earnings is relatively low.

29% are saving to buy their first home and 26% are saving for retirement. It is clear there are ongoing concerns about pay progression, as only 26% of accountancy professionals believe they will reach their salary goals if they remain in their current role.

While pay remains an important factor, many emphasised that fairness, recognition and supportive management are equally important.

Another accountancy professional said, “I wish employers would start valuing hard-working employees and pay an appropriate and competitive wage.”

Accountancy professionals aren't entirely motivated by money and are looking for a competitive salary accompanied by a positive workplace culture and opportunities for growth.

One accountancy professional said, "Salary isn't everything. Working in a place with a great team and loving your role can sometimes be better than earning top salaries. Having a great manager who supports you personally and professionally is a win-win!"

Perks and benefits

The findings in this section explores what perks and benefits accountancy professionals are seeking in their role in 2026.

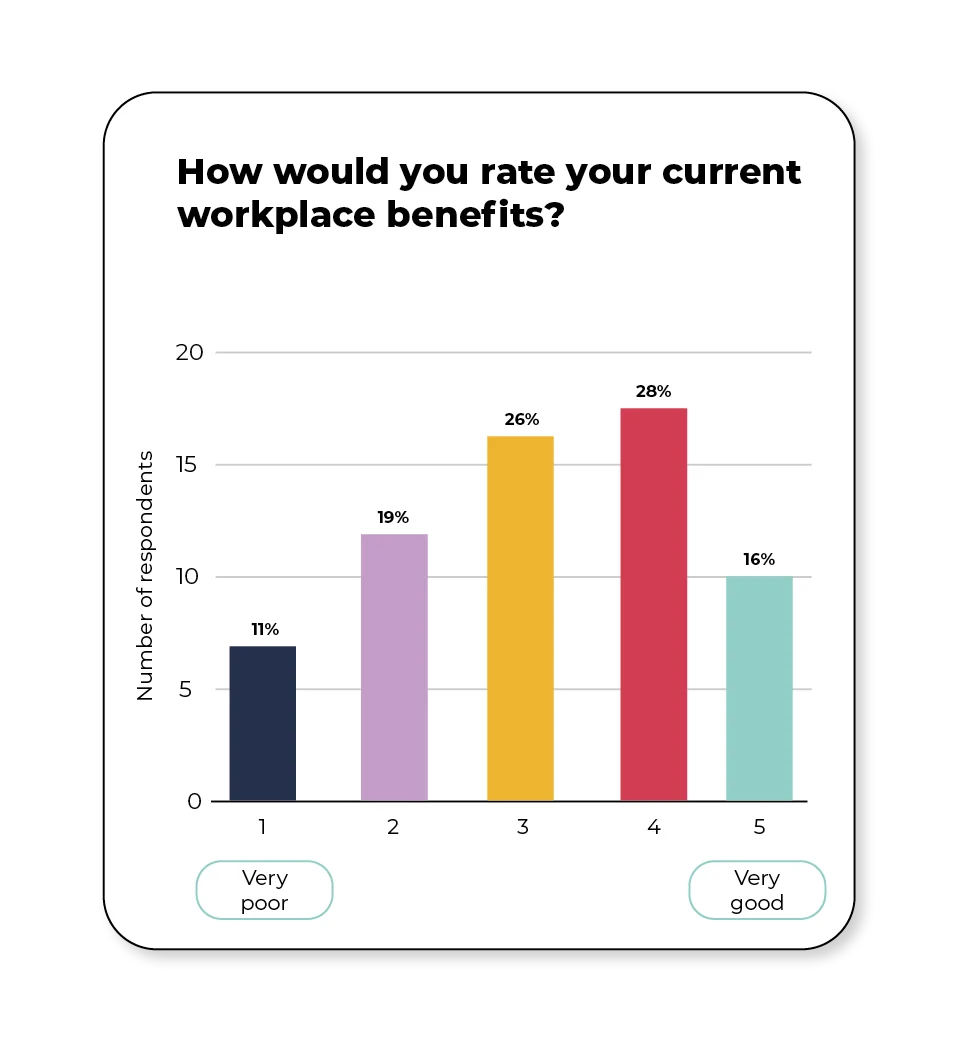

How would you rate your current workplace benefits?

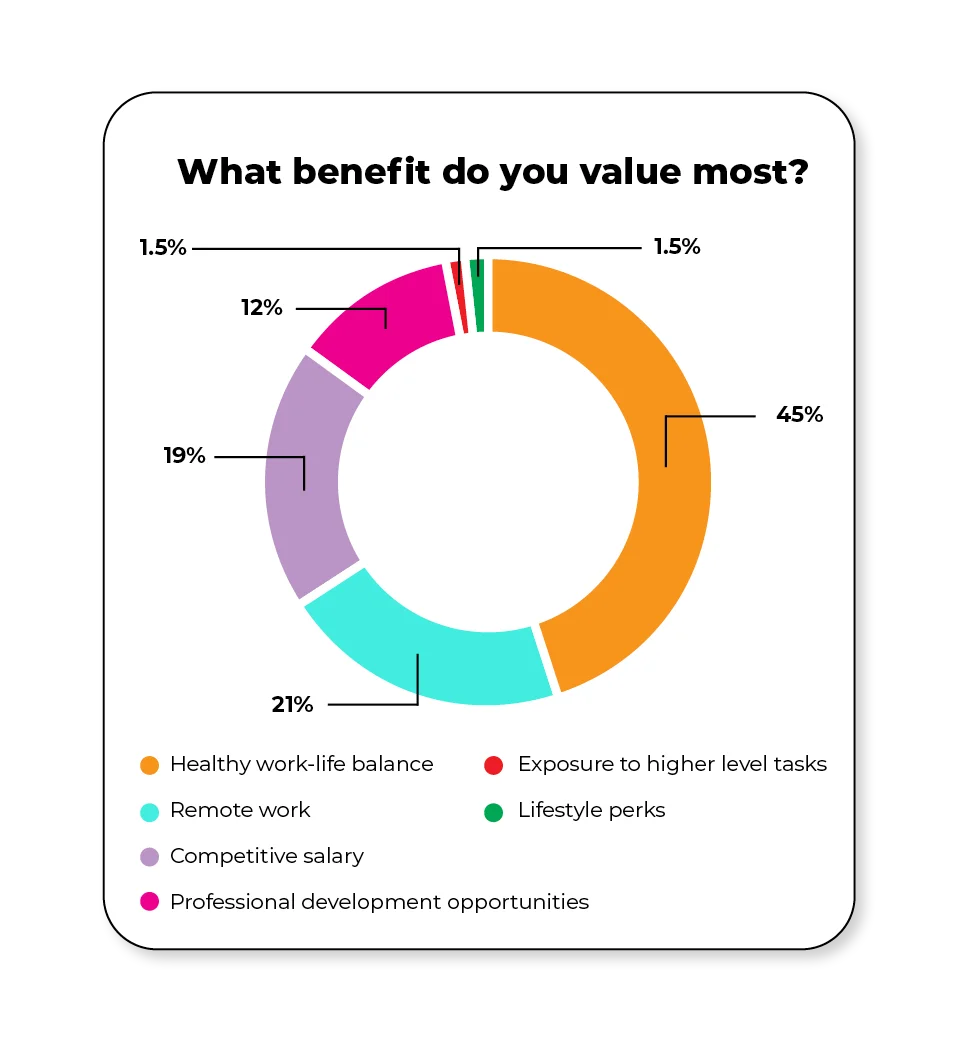

What benefits do you value most?

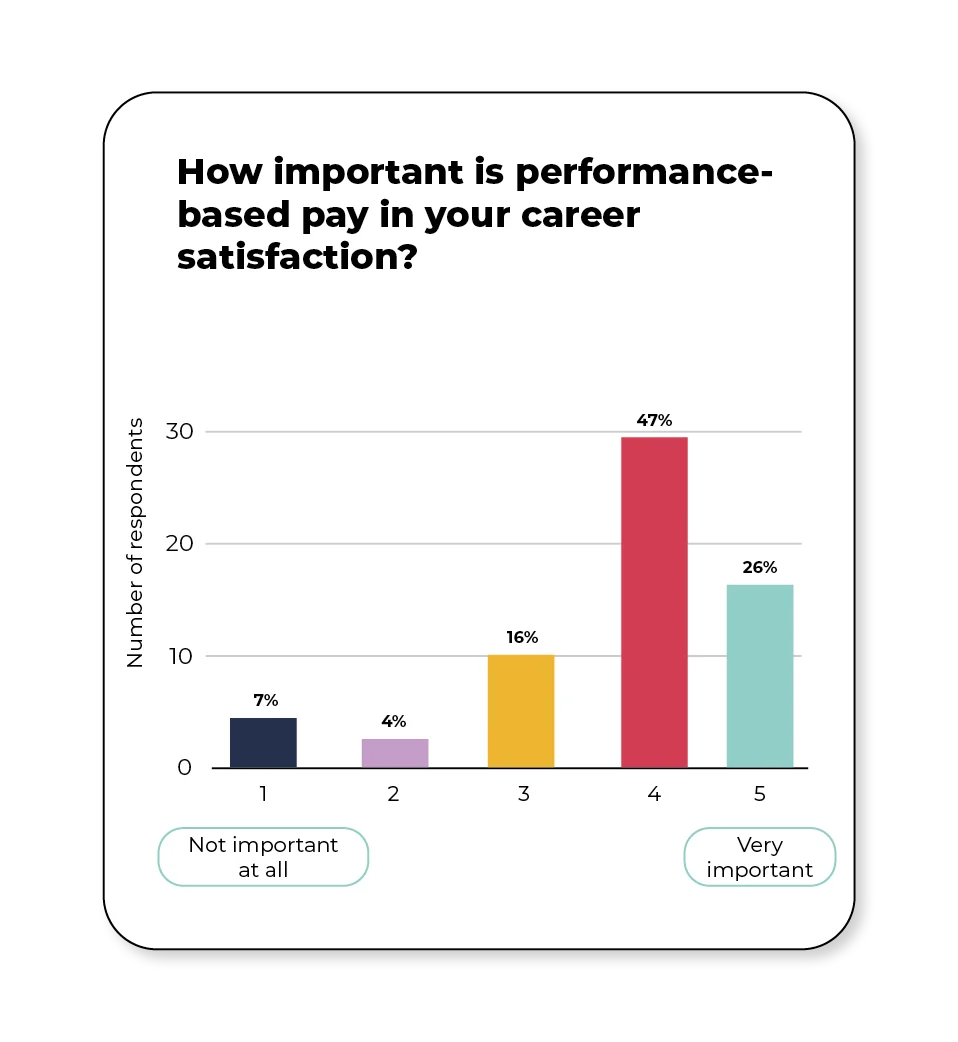

How important is performance based pay in your career satisfaction?

Perks and benefits key findings

When evaluating employee perks and benefits, some accountancy professionals emphasised the need to consider the total package, including salary, flexibility and career development opportunities.

One accountancy professional said “It’s important to consider total benefits, not just salary, holidays and pension.”

Accountancy professionals are looking for benefits beyond salary and monetary perks, with some considering work-life balance and flexible working opportunities to be just as beneficial.

Another accountancy professional added "I receive a performance-based bonus and I work in a hybrid office/remote arrangement, which benefits me."

When asked which benefits they value most, 45% of respondents cited a healthy work-life balance, followed by 21% who prioritised remote work.

There has been a growing dissatisfaction since last year's What Accountancy and Finance Professionals Are Really Looking for in a Job in 2025 report as 19% of respondents rated their benefits as poor or below average in 2025, compared to none in 2024. This may stem from a lack of understanding or support for preferred perks such as hybrid working arrangements.

Interestingly, most professionals agree that performance-based pay is a fair and effective way to motivate employees and align individual and team performance with company objectives.

One accountancy professional said “I believe that performance-based pay is a good reward for what you're doing.”

Nearly three quarters (73%) said that performance-based pay is ‘important’ or ‘very important’ to their career satisfaction.

Company culture

The data within this section highlights the desired company culture of professionals in the accountancy sector.

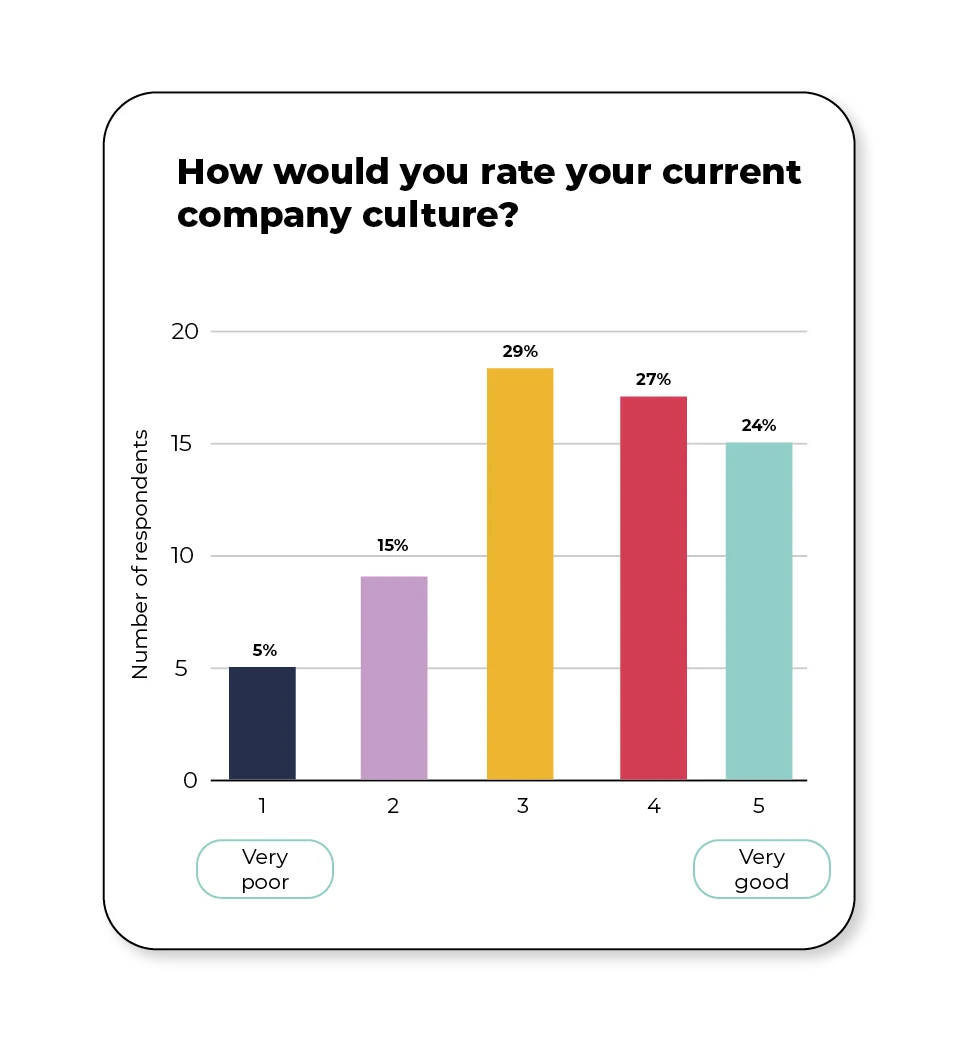

How would you rate your current company culture?

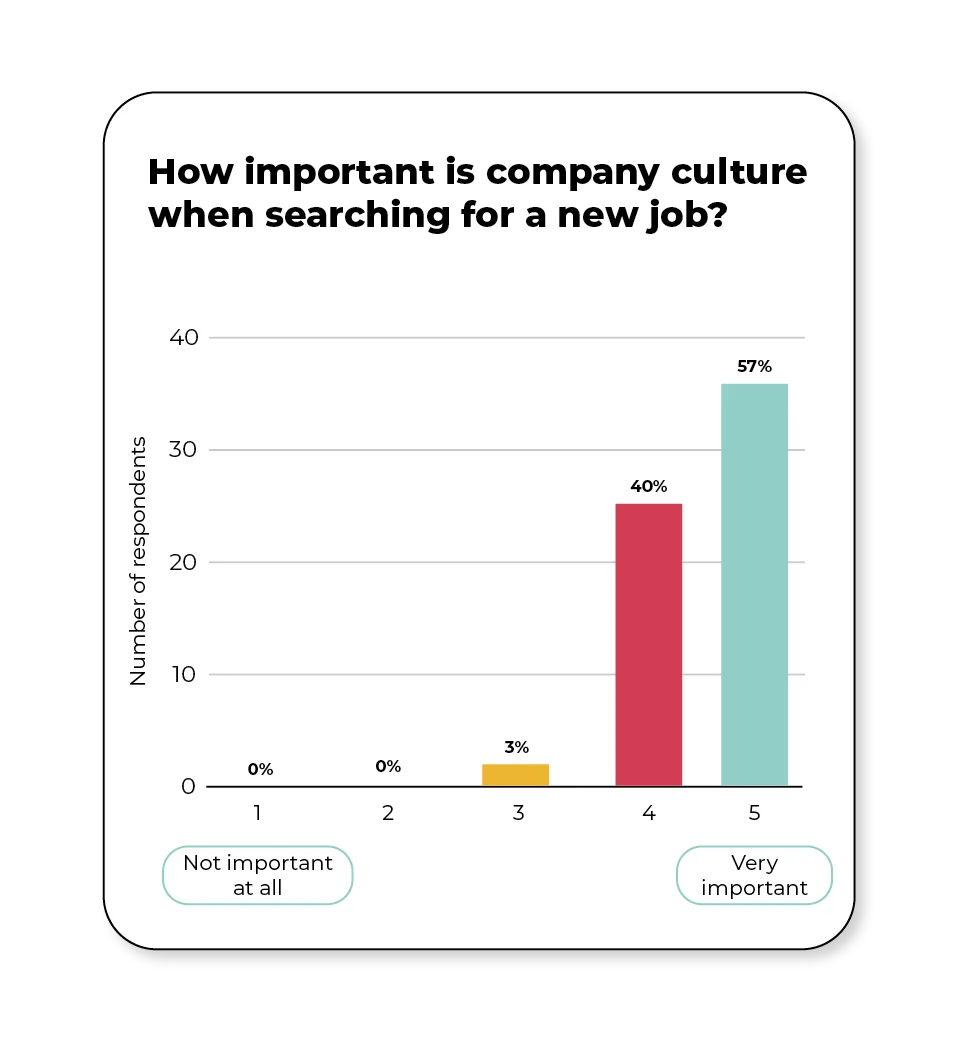

How important is company culture when searching for a job?

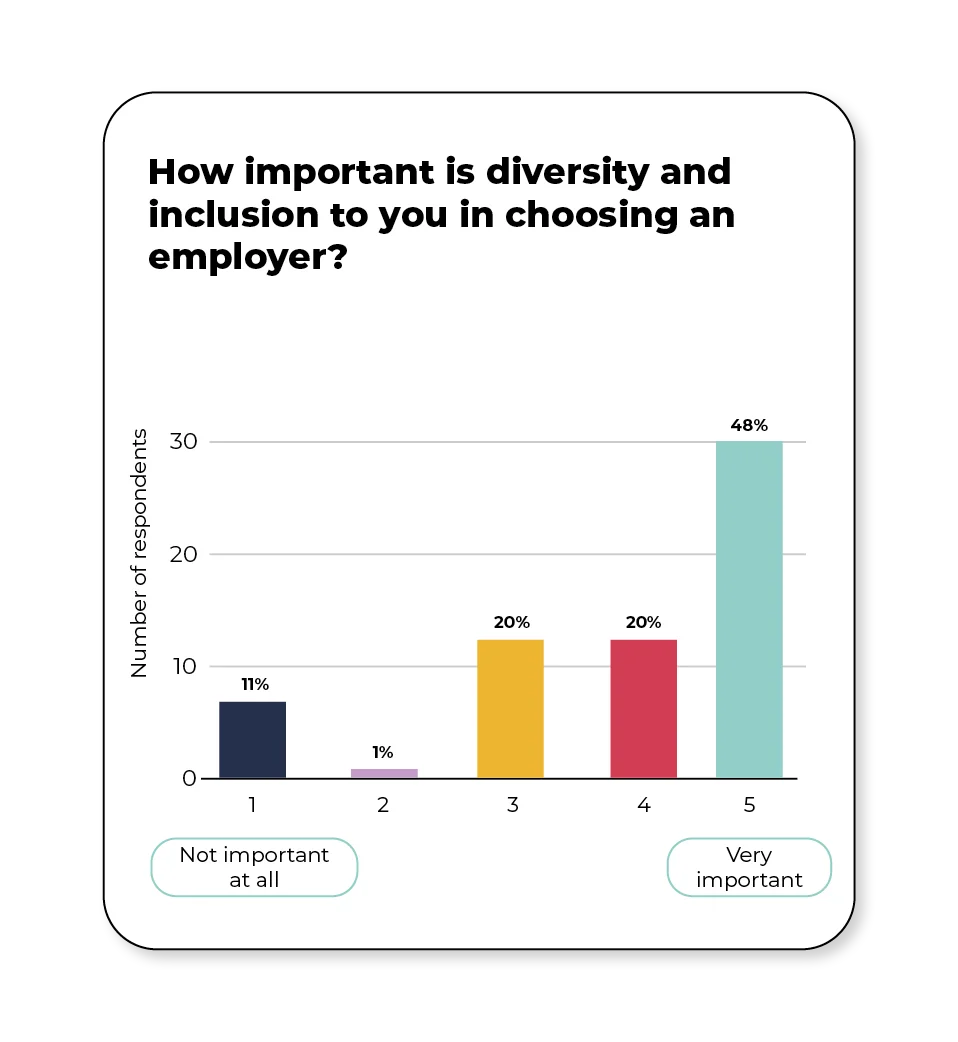

How important is diversity and inclusion to you in choosing an employer?

Company culture key findings

Company culture continues to play a defining role in how accountancy professionals assess their workplaces and future employers. While just over half (51%) rate their current company culture as ‘good’ or ‘very good,’ one in five describe it as ‘poor’ or ‘very poor,’ meaning that not all organisations are meeting expectations.

One accountancy professional said “Company culture shows how healthy a company is. If the culture is rotten, then being an employee will only cause discomfort and upset. I am an open-minded person and I will welcome anyone to the discussion table. Any company I work for must have the same attitude.”

The significance of culture is unmistakable and 97% of respondents say it is ‘important’ or ‘very important’ when searching for a job. Diversity and inclusion also remain meaningful factors in the private sector, with nearly half (48%) considering them important in choosing an employer.

Despite this, one accountancy professional added “Although I prefer a diverse team, it is not going to stop me from working in a role if it is right for me.”

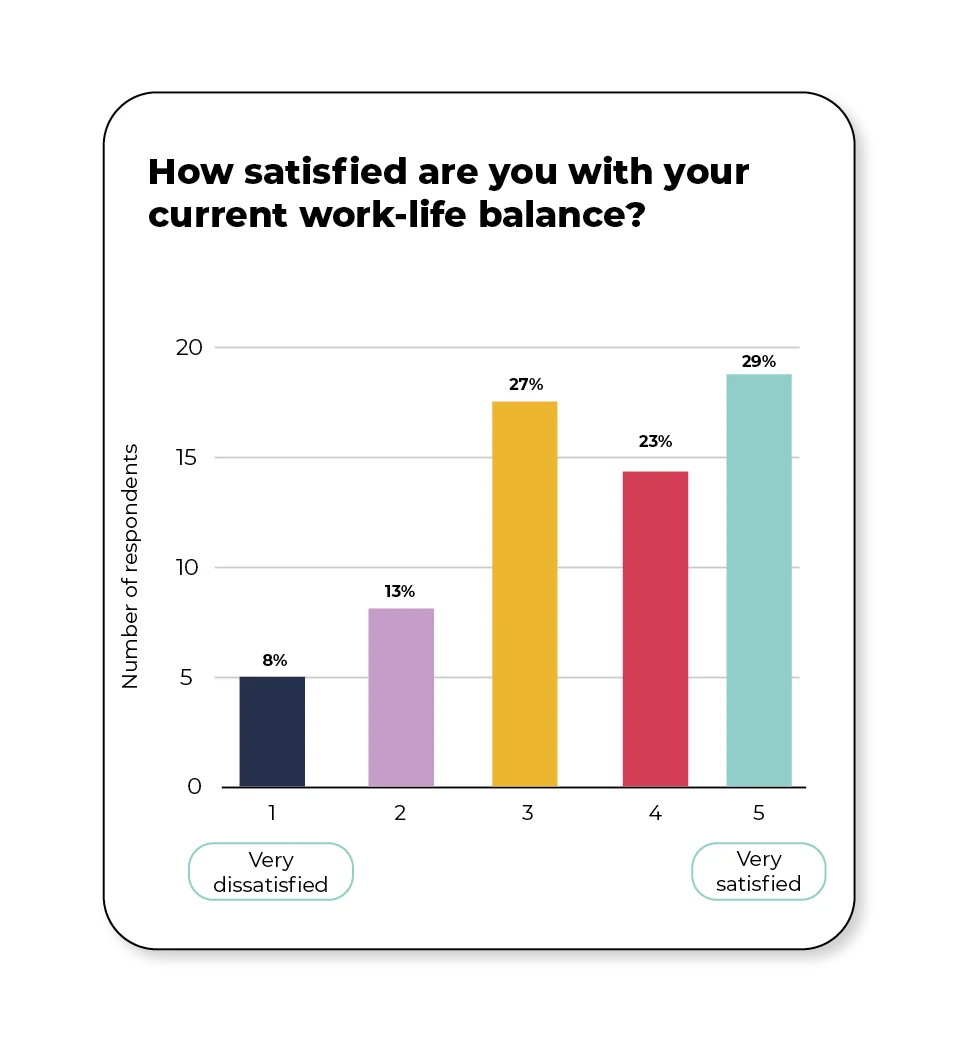

Work-life balance appears closely linked to perceptions of culture, with 51% feeling ‘satisfied’ or ‘very satisfied,’ yet 20% reporting some level of dissatisfaction.

One accountancy professional said, “It’s important that firms believe in flexibility and culture to support staff and help them feel valued.”

Professionals are increasingly viewing company culture as the foundation of engagement, wellbeing and productivity. Others emphasise values such as flexibility, inclusivity and mutual respect as indicators of a healthy and supportive workplace.

One accountancy professional said, “I think company culture is vital for both performance and growth. A great atmosphere makes a great team!”

Across the profession, there’s a clear understanding that diversity and inclusion strengthen workplaces. When different voices and perspectives come together, they create a culture that inspires creativity, improves performance and helps retain talent

Another accountancy professional said, "I believe that when searching for a job, the first thing to consider is a company’s culture and whether it aligns with your values. A happy employee equals high productivity.”

Work-life balance and flexibility

This section explores how accountancy professionals feel about work-life balance and flexibility in the profession going into 2026.

How satisfied are you with your current work-life balance?

How important is paid time off and holiday policies when searching for a new job?

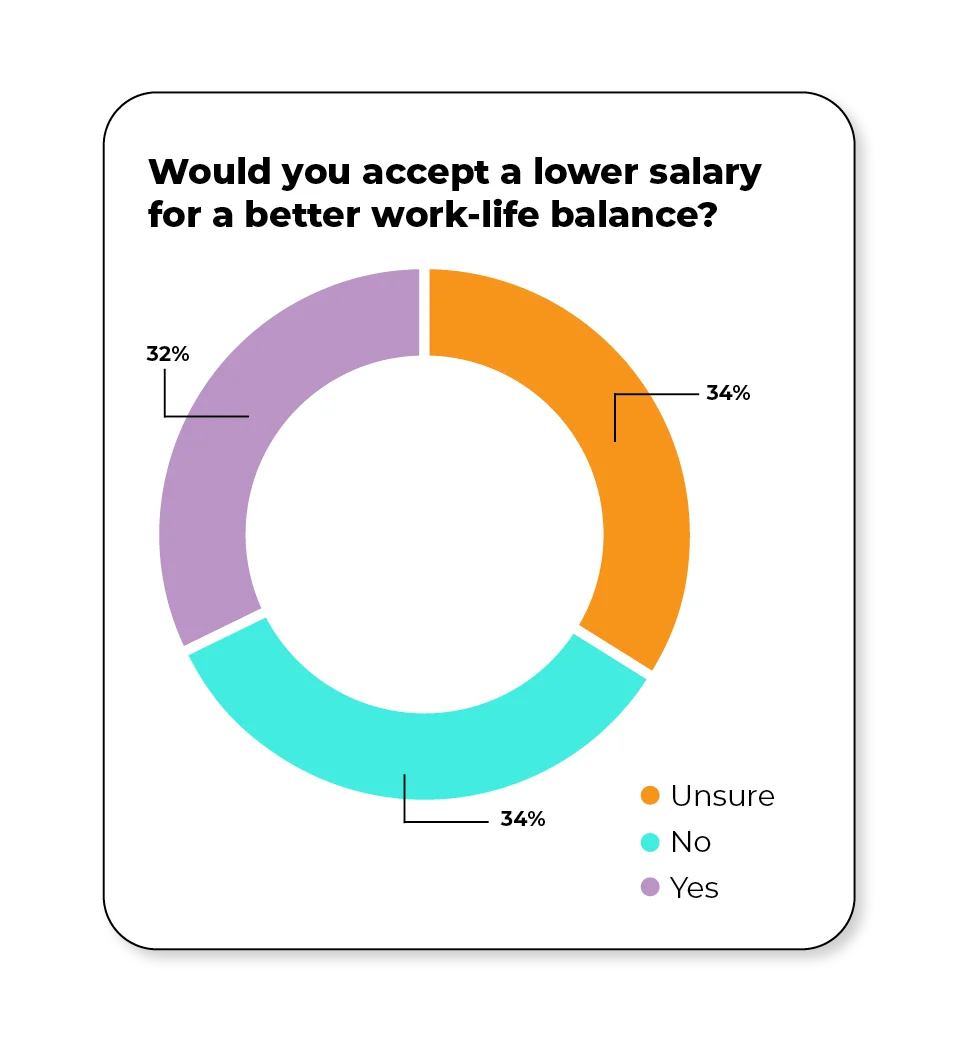

Would you accept a lower salary for a better work-life balance?

Work-life balance and flexibility key findings

When considering new opportunities, paid time off and holiday policies are critical factors, with 84% rating them as ‘important’ or ‘very important.’ Professionals are also becoming more open to compromise, as 32% would now accept a lower salary for a better work-life balance, compared to 23% who said they wouldn’t in 2024.

One accountancy professional said, “This year, I moved to another role for a better work-life balance.”

This shift highlights how attitudes towards balance and financial gain have evolved over the past year, with professionals increasingly prioritising wellbeing, flexibility and improved quality of life.

One accountancy professional said, “Transparency about hybrid working is important. Companies pushing for a return to the office and trying to justify this in the name of ‘collaboration’ remove the flexibility that employees are looking for. In a world full of technology, companies should foster collaboration both online and in person while respecting the adjustments each employee needs for their work-life balance.”

Flexibility is increasingly seen as essential, with professionals valuing remote and hybrid working, as well as alternative schedules like four-day weeks, for their ability to reduce stress and improve productivity.

One accountancy professional said, “A shorter working week with 4 long days is better for everyone.”

Another accountancy professional agreed, adding, “Being able to adjust your schedule or work remotely when needed helps you maintain focus and reduce stress, often leading to better performance.”

Ultimately, professionals believe that work-life balance and flexibility are fundamental to a healthy company culture that respects individual needs while fostering collaboration and long-term engagement.

A fifth accountancy professional added “Work-life balance and flexibility need to be important factors for an organisation to create a good work culture.”

Career progression and development

The findings in this section reveals the main drivers influencing career motivation and satisfaction for accountancy professionals in 2026.

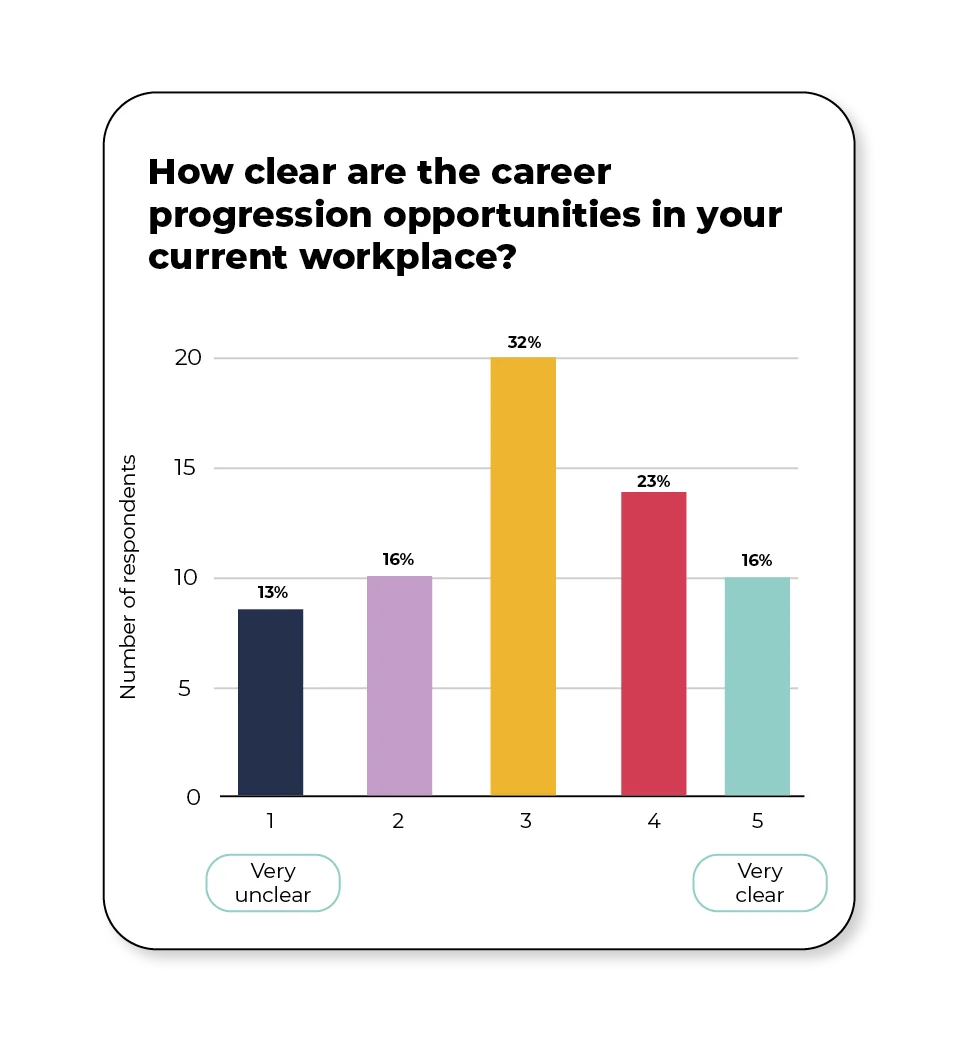

How clear are the career progression opportunities in your current workplace?

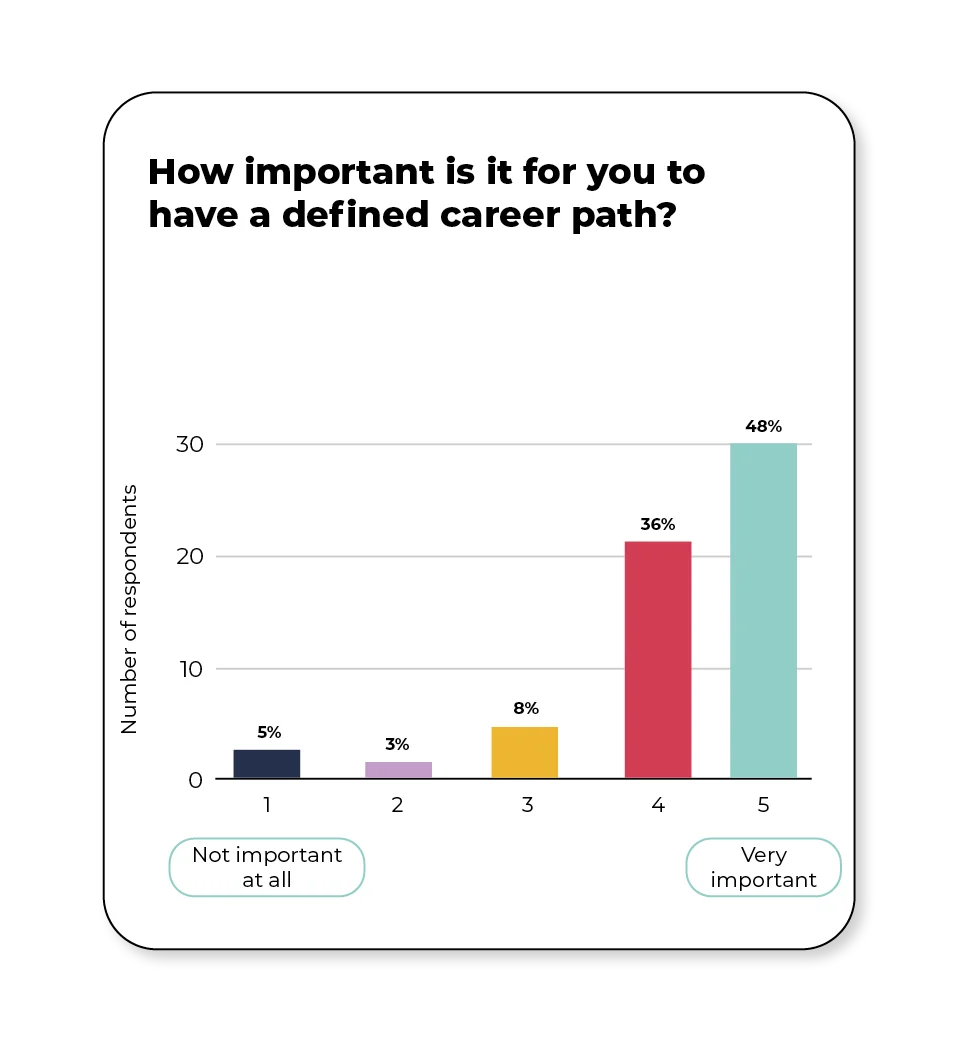

How important is it for you to have a defined career path?

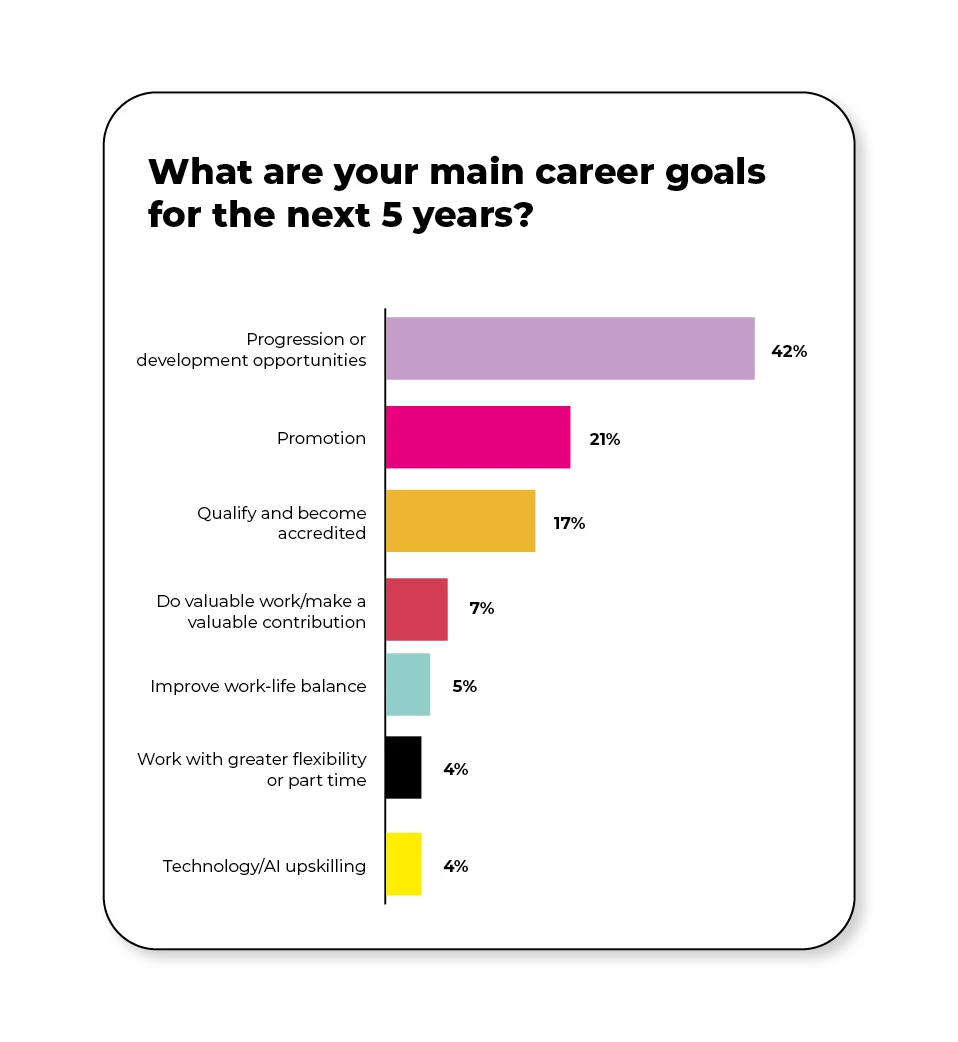

What are your main career goals for the next 5 years?

Career progression and development key findings

In 2024, just 12% of professionals identified professional development as the most important perk going into 2025. Now, priorities have shifted and when asked about their main career goals for the next 5 years, 42% cite progression or development opportunities, followed by 21% who want a promotion.

One accountancy professional said, “It is important to have good development plans for individuals and support choices.”

In contrast, only 5% aim to improve their work-life balance and 4% seek greater flexibility. This shift highlights that professional growth has become a defining focus for accountancy professionals, if not immediately, then certainly in the near future.

Another accountancy professional said, “The main reason for changing roles before has been a lack of clear career progression.”

While nearly half (48%) believe it is important to have a clearly defined career path, many feel uncertain about the routes available to them.

One accountancy professional said, “A clear path on how to develop is important. Managers and companies need to set goals and work with the employee to understand where they want to be. Allow them to earn promotions and gain more responsibility in the areas they are interested in.”

To meet these expectations, employers could provide clearer pathways for advancement and actively support employees’ ambitions. Doing so not only helps professional progress but also strengthens retention.

Another accountancy professional said, “I am currently on level 2 (soon to be level 3) of the CIMA professional accounting exams. I have worked very hard and have been promoted by my employer several times in the 5 years I have been with the company. They believe in nurturing talent and are paying for my studies. I plan to be with them for many years, as there are great progression opportunities and the culture is fantastic, getting better every year with the new ideas they are bringing to the table.”

Those who feel supported and see opportunities to grow are more likely to remain within their organisation, while others may look elsewhere for employers that prioritise career development and recognise potential.

A fifth accountancy professional added, “With apprenticeships changing in 2026, it may become a challenging time for young people entering the accounting profession. This could lead to a decline in nearly qualified students coming through the ranks with practical experience, in favour of graduates who have less hands-on experience.”

Conclusion

2026 marks a key turning point for the accountancy sector with the implementation of Making Tax Digital and the acceleration of AI and automation, combined with the continued shortage of skilled professionals.

With changing systems, as well as shifting values and expectations, it's important for employers to consider the professional opinions and needs of all employees as they navigate new requirements.

In spite of this, our report revealed that Making Tax Digital is a lower priority compared to other emerging challenges in 2026. The most significant finding was the growing desire for more flexible working options, structured career development programmes and competitive reward initiatives.

Employee recognition and financial incentives remain key drivers of motivation and engagement for those who feel their contributions have a direct impact on the bottom line of the business.

Employers who show an interest in employee satisfaction, career goals and company culture reap the benefits of higher engagement, stronger retention and improved overall performance.

Flexibility and remote work options, as well as development opportunities, remain top priorities for accountancy professionals seeking balance, wellbeing and career satisfaction.

Investing in Continued Professional Development is crucial, not only for maintaining professional competence and improving work quality, but also for meeting regulatory requirements and supporting long-term growth.

No doubt, the preferences of accountancy professionals will continue to evolve as the sector undergoes dynamic and rapid transformation. Employers who adapt, listen, and proactively address these changing needs will be best positioned to attract, develop and retain top talent in the years ahead.

Methodology

The data in our report were collected via an online survey created by Spencer Clarke Group, published through Google Forms.

The online survey was distributed to accountancy professionals across the UK via email and LinkedIn. The survey was answered by sixty-two qualified professionals of varying experience working in the private sector. This included professionals ranging from Accountants, Bookkeepers and Payroll Managers to Audit Seniors and Tax Managers.

The main objective of our report is to identify what accountancy professionals are looking for in a job in 2026 and the factors that may influence them to seek new opportunities.

Both the qualitative and quantitative research methods were used to collect information. Qualitative data was used to identify emerging patterns, understand opinions and attitudes and draw conclusions.

Qualitative data was used to generate new hypotheses, trends and anomalies. Detailed responses provided meaningful insight into emerging challenges and gave meaning to individual answers.

The qualitative data method also helped to uncover societal trends and opportunities for growth and improvement within the profession.

Accountancy jobs

If you’re searching for your next accountancy job, why not take a look at the latest vacancies, or simply upload your CV to be notified when a relevant position becomes available.

Accountancy recruitment services

As specialist accountancy recruiters, we support practices nationwide with their permanent recruitment needs.

Whether you’re searching for a tax, audit or payroll specialist, we will help you to find whoever you need to make your practice thrive.

If you’re struggling to fill a vacancy, why not get in touch with Senior Consultant Lauren Fisher on 01772 954200 to see how we can help?

Who is Spencer Clarke Group?

Established in 2017, we’re an award winning and progressive recruitment agency based in the heart of the North West. Our reputation is built on trust, expertise and an unwavering commitment to exceed expectations.

In 2025, Spencer Clarke Group was awarded Best Public/Third Sector Recruitment Agency and Best Temporary Recruitment Agency at the Recruiter Awards. In 2024, Spencer Clarke Group was also named Recruitment Agency of the Year.